%matplotlib inline

import numpy as np

np.set_printoptions(precision=3)

import pandas as pd

import matplotlib.pyplot as plt

import matplotlib.ticker as mtick

import seaborn as sns

import jsonCredit Risk Analysis

| Author: | Mahbub Alam |

Introduction

End-to-end Credit Risk Analysis using the German Credit dataset.

Steps:

- Data quality checks

- Exploratory data analysis (EDA)

- PD (Probability of Default) modeling and model validation (using Pipeline, GridSearchCV, and CalibratedClassifierCV)

- LGD (Loss Given Default) simulation + Random Forest model

- EAD (Exposure at Default) simulation

- ECL (Expected Credit Loss) calculation

- Visualization of risk segments, summaries by Purpose, Property, and EAD buckets

- Stress testing under adverse scenarios

Data quality checks

Summary:

- Inspect schema and datatypes

- Check for missing values

- Remove duplicates

- Count unique values per column

- Check class balance of the target (Risk: good/bad)

df = pd.read_csv('full_german_credit_dataset.csv')

# print(df.head())

print(f"")

print(df.info())

# Check missing data

missing_data = df.isna().any()

print(f"Missing data? - {'Yes' if missing_data.any() else 'No'}")

# Drop perfect duplicate rows

before = len(df)

df = df.drop_duplicates()

print(f"Duplicates removed: {before - len(df)}")

# check unique values

nunique = df.nunique().to_dict()

print(f"")

print(f"Unique values per column:\n\n{json.dumps(nunique, indent=4)}")

# Zero-variance check

zero_var = np.array([k for k in nunique if nunique[k] <= 1])

print(f"")

print(f"No. of columns with no variability (only one unique value): {len(zero_var)}")

print(f"")

# print(df['Risk'].head())

vc = df['Risk'].value_counts()

vcp = df['Risk'].value_counts(normalize=True)

class_balance = pd.DataFrame({'count' : vc, 'proportion' : vcp})

print(f"")

print(f"Class balance of the target (Risk):\n\n{class_balance}")

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1000 entries, 0 to 999

Data columns (total 21 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Status_of_existing_checking_account 1000 non-null object

1 Duration_in_month 1000 non-null int64

2 Credit_history 1000 non-null object

3 Purpose 1000 non-null object

4 Credit_amount 1000 non-null int64

5 Savings_account_bonds 1000 non-null object

6 Present_employment_since 1000 non-null object

7 Installment_rate_in_percentage_of_disposable_income 1000 non-null int64

8 Personal_status_and_sex 1000 non-null object

9 Other_debtors_guarantors 1000 non-null object

10 Present_residence_since 1000 non-null int64

11 Property 1000 non-null object

12 Age_in_years 1000 non-null int64

13 Other_installment_plans 1000 non-null object

14 Housing 1000 non-null object

15 Number_of_existing_credits_at_this_bank 1000 non-null int64

16 Job 1000 non-null object

17 Number_of_people_being_liable_to_provide_maintenance_for 1000 non-null int64

18 Telephone 1000 non-null object

19 Foreign_worker 1000 non-null object

20 Risk 1000 non-null object

dtypes: int64(7), object(14)

memory usage: 164.2+ KB

None

Missing data? - No

Duplicates removed: 0

Unique values per column:

{

"Status_of_existing_checking_account": 4,

"Duration_in_month": 33,

"Credit_history": 5,

"Purpose": 10,

"Credit_amount": 921,

"Savings_account_bonds": 5,

"Present_employment_since": 5,

"Installment_rate_in_percentage_of_disposable_income": 4,

"Personal_status_and_sex": 4,

"Other_debtors_guarantors": 3,

"Present_residence_since": 4,

"Property": 4,

"Age_in_years": 53,

"Other_installment_plans": 3,

"Housing": 3,

"Number_of_existing_credits_at_this_bank": 4,

"Job": 4,

"Number_of_people_being_liable_to_provide_maintenance_for": 2,

"Telephone": 2,

"Foreign_worker": 2,

"Risk": 2

}

No. of columns with no variability (only one unique value): 0

Class balance of the target (Risk):

count proportion

Risk

good 700 0.7

bad 300 0.3Encoding Risk

Encoding target variable Risk into numeric (1=bad, 0=good). This prepares the dataset for supervised learning models.

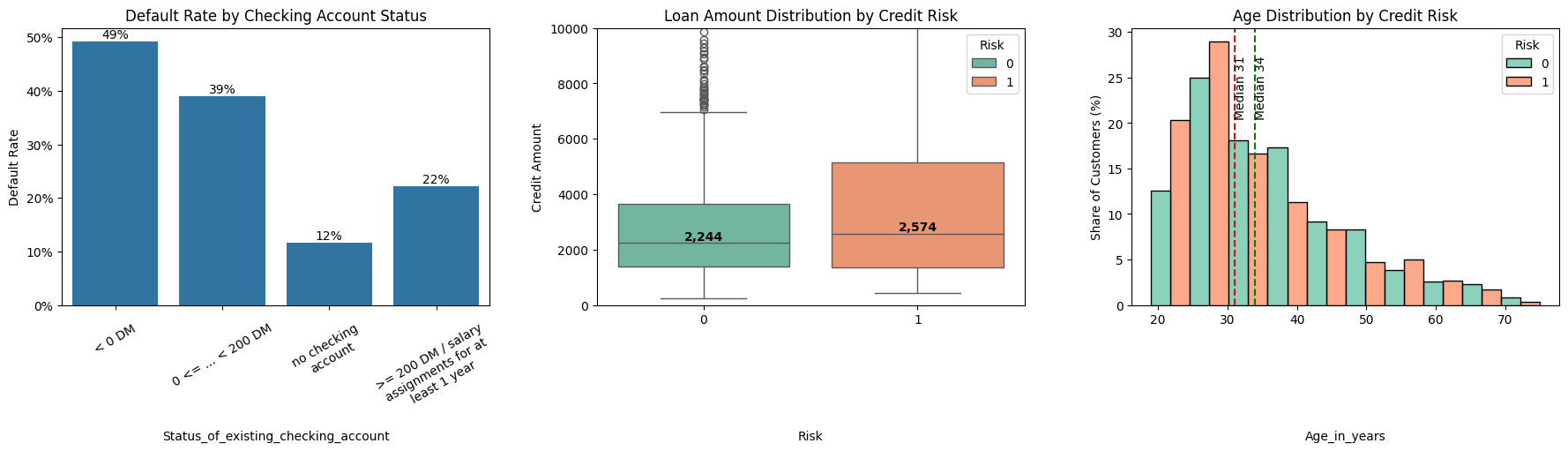

df["Risk"] = (df["Risk"] == "bad").astype(int)EDA with Account status, Loan amount and Age

Exploring how credit risk correlates with key features such as:

- Account status (barplot of default rates)

- Loan amount (boxplots by Risk)

- Age (histograms + median lines by Risk)

import textwrap

def wrap_labels_(ax, width=15, rotation=0, ha="right", pad=5):# {{{

"""Wrap long labels on x-axis"""

ticks = ax.get_xticks()

labels = [label.get_text() for label in ax.get_xticklabels()]

# Wrap long labels

wrapped_labels = ["\n".join(textwrap.wrap(l, width=width)) for l in labels]

# Set ticks + labels explicitly

ax.set_xticks(ticks)

if ha == "at_tick":

ax.set_xticklabels(wrapped_labels, rotation=rotation)

for label in ax.get_xticklabels():

label.set_x(label.get_position()[0])

else:

ax.set_xticklabels(wrapped_labels, rotation=rotation, ha=ha)

# Adjust padding

ax.tick_params(axis="x", pad=pad)

_, axes = plt.subplots(1, 3, figsize=(18, 6), num="risk_vs_acc_status_credit_amount_and_age")

# risk vs account status

ax = sns.barplot(

x="Status_of_existing_checking_account",

y="Risk",

data=df,

errorbar=None,

estimator=np.mean,

ax=axes[0]

)

# adding percentage on top of the bars

for p in ax.patches:

value = p.get_height()

ax.annotate(f"{value:.0%}",

(p.get_x() + p.get_width()/2, value),

ha="center", va="bottom", fontsize=10)

ax.yaxis.set_major_formatter(mtick.PercentFormatter(xmax=1, decimals=0))

wrap_labels_(ax, width=18, rotation=30, ha="at_tick", pad=10)

ax.set_title("Default Rate by Checking Account Status")

ax.set_ylabel("Default Rate")

# risk vs credit amount

ax = sns.boxplot(

x="Risk",

y="Credit_amount",

data=df,

# showfliers=False,

hue="Risk",

dodge=False,

palette="Set2",

ax=axes[1]

)

# Add median annotations

medians = df.groupby("Risk")["Credit_amount"].median()

for i, median in enumerate(medians):

ax.text(i, median, f"{median:,.0f}",

ha="center", va="bottom", fontsize=10, fontweight="bold", color="black")

ax.set_ylim(0, 10000)

ax.set_title("Loan Amount Distribution by Credit Risk")

ax.set_xlabel("Risk")

ax.set_ylabel("Credit Amount")

# risk vs age

ax = sns.histplot(

data=df,

x="Age_in_years",

hue="Risk",

bins=10,

multiple="dodge",

stat="percent",

common_norm=False,

palette="Set2",

ax=axes[2]

)

# Add median lines for each group

medians = df.groupby("Risk")["Age_in_years"].median()

colors = {0: "green", 1: "red"}

for risk_val, median in medians.items():

ax.axvline(median, color=colors[risk_val], linestyle="--", linewidth=1.5)

ax.text(median, ax.get_ylim()[1]*0.9, f"Median {median:.0f}",

rotation=90, ha="left", va="top", fontsize=10)

ax.set_title("Age Distribution by Credit Risk")

ax.set_xlabel("Age_in_years")

ax.set_ylabel("Share of Customers (%)")

for ax in axes:

ax.xaxis.set_label_coords(0.5, -0.45)

plt.tight_layout(pad=1.5)

plt.subplots_adjust(wspace=0.25)

plt.savefig('risk_vs_acc_status_credit_amount_and_age.jpg')

plt.show()PD model

This is the Probability of Default (PD) modeling step (Basel/IFRS 9).

- Train Logistic Regression model to predict PD.

- Use preprocessing pipeline with scaling + one-hot encoding.

- Tune hyperparameters via GridSearchCV (refit on ROC-AUC).

- Calibrate final model using isotonic regression to align predicted PDs with observed default rates (CalibratedClassifierCV).

from sklearn.model_selection import train_test_split, GridSearchCV, StratifiedKFold

from sklearn.compose import ColumnTransformer

from sklearn.preprocessing import StandardScaler, OneHotEncoder

from sklearn.pipeline import Pipeline

from sklearn.linear_model import LogisticRegression

from sklearn.calibration import CalibratedClassifierCV

from sklearn.metrics import (roc_auc_score, brier_score_loss,

make_scorer, average_precision_score, roc_curve,

confusion_matrix, accuracy_score, recall_score)

X = df.drop(columns=['Risk']).copy()

y = df['Risk']

num_features = X.columns[X.dtypes.apply(lambda dt : np.issubdtype(dt, np.number))].tolist()

cat_features = [col for col in X.columns if col not in num_features]

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42, stratify=y)

pre = ColumnTransformer(

transformers = [

("num", StandardScaler(), num_features),

("cat", OneHotEncoder(), cat_features)

])

pd_pipe = Pipeline([

("pre", pre),

("logreg", LogisticRegression(max_iter = 1000, solver = "liblinear", random_state = 1))

])

hparams = {

'logreg__penalty': ['l1', 'l2'],

'logreg__C': np.logspace(-3, 3, 13),

'logreg__class_weight': [None, 'balanced'],

'logreg__fit_intercept': [True, False],

'logreg__tol': [1e-4, 1e-5]

}

cv = StratifiedKFold(n_splits=5, shuffle=True, random_state = 2)

scorers = {

"roc_auc": "roc_auc",

"pr_auc": make_scorer(average_precision_score, response_method="predict_proba"),

"brier": make_scorer(brier_score_loss, response_method="predict_proba", greater_is_better=False)

}

grid = GridSearchCV(

pd_pipe,

hparams,

scoring = scorers,

cv = cv,

n_jobs = 4,

refit = "roc_auc"

)

grid.fit(X_train, y_train)

best_model = grid.best_estimator_

# Calibrate best model using isotonic regression, this ensures PDs align with observed default rates

cal_pd = CalibratedClassifierCV(estimator = best_model, method = "isotonic", cv = 5)

cal_pd.fit(X_train, y_train)CalibratedClassifierCV(cv=5,

estimator=Pipeline(steps=[('pre',

ColumnTransformer(transformers=[('num',

StandardScaler(),

['Duration_in_month',

'Credit_amount',

'Installment_rate_in_percentage_of_disposable_income',

'Present_residence_since',

'Age_in_years',

'Number_of_existing_credits_at_this_bank',

'Number_of_people_being_liable_to_provide_maintenance_for']...

'Purpose',

'Savings_account_bonds',

'Present_employment_since',

'Personal_status_and_sex',

'Other_debtors_guarantors',

'Property',

'Other_installment_plans',

'Housing',

'Job',

'Telephone',

'Foreign_worker'])])),

('logreg',

LogisticRegression(C=np.float64(0.03162277660168379),

fit_intercept=False,

max_iter=1000,

random_state=1,

solver='liblinear'))]),

method='isotonic')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Parameters

| estimator | Pipeline(step...liblinear'))]) | |

| method | 'isotonic' | |

| cv | 5 | |

| n_jobs | None | |

| ensemble | 'auto' |

Parameters

| transformers | [('num', ...), ('cat', ...)] | |

| remainder | 'drop' | |

| sparse_threshold | 0.3 | |

| n_jobs | None | |

| transformer_weights | None | |

| verbose | False | |

| verbose_feature_names_out | True | |

| force_int_remainder_cols | 'deprecated' |

['Duration_in_month', 'Credit_amount', 'Installment_rate_in_percentage_of_disposable_income', 'Present_residence_since', 'Age_in_years', 'Number_of_existing_credits_at_this_bank', 'Number_of_people_being_liable_to_provide_maintenance_for']

Parameters

| copy | True | |

| with_mean | True | |

| with_std | True |

['Status_of_existing_checking_account', 'Credit_history', 'Purpose', 'Savings_account_bonds', 'Present_employment_since', 'Personal_status_and_sex', 'Other_debtors_guarantors', 'Property', 'Other_installment_plans', 'Housing', 'Job', 'Telephone', 'Foreign_worker']

Parameters

| categories | 'auto' | |

| drop | None | |

| sparse_output | True | |

| dtype | <class 'numpy.float64'> | |

| handle_unknown | 'error' | |

| min_frequency | None | |

| max_categories | None | |

| feature_name_combiner | 'concat' |

Parameters

| penalty | 'l2' | |

| dual | False | |

| tol | 0.0001 | |

| C | np.float64(0....2277660168379) | |

| fit_intercept | False | |

| intercept_scaling | 1 | |

| class_weight | None | |

| random_state | 1 | |

| solver | 'liblinear' | |

| max_iter | 1000 | |

| multi_class | 'deprecated' | |

| verbose | 0 | |

| warm_start | False | |

| n_jobs | None | |

| l1_ratio | None |

Model validation

Generating validation report for the PD model. Discrimination (ROC-AUC, Gini) and calibration (Brier score) are the primary validation metrics.

- ROC-AUC and Gini coefficient (discrimination power)

- Brier score (calibration quality)

- Average precision score

- KS statistic (max separation between good/bad)

Threshold-based metrics at KS-optimal threshold:

- KS-optimal threshold

- Metrics at that threshold: Accuracy, Recall, Specificity, Confusion matrix

proba_test = cal_pd.predict_proba(X_test)[:,1]

print(f"Test AUC: {roc_auc_score(y_test, proba_test):.3f}")

gini = 2*roc_auc_score(y_test, proba_test) - 1

print(f"Gini coefficient: {gini:.3f}")

print(f"Brier score: {brier_score_loss(y_test, proba_test):.4f}")

print(f"Average precision score: {average_precision_score(y_test, proba_test):.4f}")

fpr, tpr, thresholds = roc_curve(y_test, proba_test)

ks_index = (tpr - fpr).argmax()

ks_stat = tpr[ks_index] - fpr[ks_index]

print(f"KS Statistic: {ks_stat:.3f}")

print(f"")

y_pred_ks = (proba_test >= thresholds[ks_index]).astype(int)

print(f"Optimal KS threshold: {thresholds[ks_index]:.3f}")

print("Diagnostic metrics at KS threshold:")

print(f" Accuracy: {accuracy_score(y_test, y_pred_ks):.3f}")

print(f" Recall: {recall_score(y_test, y_pred_ks):.3f}")

tn, fp, fn, tp = confusion_matrix(y_test, y_pred_ks).ravel()

specificity = tn / (tn + fp)

print(f" Specificity (good capture rate): {specificity:.3f}")

print(f" Confusion Matrix:\n {confusion_matrix(y_test, y_pred_ks)}")Test AUC: 0.797

Gini coefficient: 0.593

Brier score: 0.1595

Average precision score: 0.6433

KS Statistic: 0.538

Optimal KS threshold: 0.363

Diagnostic metrics at KS threshold:

Accuracy: 0.770

Recall: 0.767

Specificity (good capture rate): 0.771

Confusion Matrix:

[[108 32]

[ 14 46]]Save the model for later

import joblib

joblib.dump(cal_pd, "pd_model_calibrated.pkl")

# Load model

# cal_pd = joblib.load("pd_model_calibrated.pkl")['pd_model_calibrated.pkl']LGD

The german credit dataset lacks information on recoveries for defaulted loans, so Loss Given Default (LGD) cannot be observed directly. We simulate LGD using a rule-based approach with random noise based on borrowers property, account status, savings, and purpose.

Later we will train a RandomForest model to estimate LGD from historical data (treating part our simulation as historical data). Predictions are floored at 10% in line with regulatory requirements CRR Article 164(4).

df_lgd = df.copy()

def lgd_simulation(row):

# setting base lgd

lgd = 0.55

prop = row.get("Property").lower()

check = row.get("Status_of_existing_checking_account").lower()

savings = row.get("Savings_account_bonds").lower()

purpose = row.get("Purpose").lower()

# Collateral

if "real estate" in prop or "building" in prop:

lgd -= 0.20

elif "car" in prop:

lgd -= 0.10

elif "unknown" in prop:

lgd += 0.05

# Liquidity buffers

if ">= 200" in check:

lgd -= 0.05

if ">= 1000" in savings or "rich" in savings:

lgd -= 0.05

# Purposes that are typically less collateralized

if purpose in ["education", "retraining", "others"]:

lgd += 0.05

return float(np.clip(lgd, 0.05, 0.95))

df_lgd["LGD_prior"] = df_lgd.apply(lgd_simulation, axis=1)

# Adding a randon noise to our simulation

rng = np.random.default_rng(42)

df_lgd["LGD_obs"] = np.where(

df_lgd["Risk"] == 1,

np.clip(df_lgd["LGD_prior"] + rng.normal(0, 0.01, size=len(df_lgd)), 0.01, 0.99),

0.0

)Simulate true defaulters

Summary:

- Sample 90% of bad credits as “true defaulters”, using PD-weighted probabilities.

- Assume that only those bad credits truly defaulted.

- Use this as “historical training data” for LGD modeling.

df_lgd["PD"] = cal_pd.predict_proba(X)[:,1]

bad_index = np.where(df_lgd["Risk"] == 1)[0]

weights = df_lgd.loc[bad_index, "PD"].to_numpy()

weights = weights / weights.sum()

rng = np.random.default_rng(43)

true_defaults = rng.choice(bad_index, size=int(0.9 * len(bad_index)), replace=False, p=weights)

df_lgd["true_default"] = 0

df_lgd.loc[true_defaults, "true_default"] = 1Random forest model for LGD

Summary:

- Train Random Forest regressor on simulated LGD data.

- Predict expected LGD (LGD_exp) for entire portfolio.

- Expected LGD predictions are floored at 10% to align with CRR Article 164(4).

from sklearn.ensemble import RandomForestRegressor

X_lgd = df_lgd.loc[true_defaults].drop(columns=["Risk", "PD", "true_default", "LGD_prior", "LGD_obs"]).copy()

y_lgd = df_lgd.loc[true_defaults, "LGD_obs"]

# print(y_lgd.head())

lgd_pre = ColumnTransformer(

transformers=[

("num", StandardScaler(), num_features),

("cat", OneHotEncoder(), cat_features),

]

)

lgd_model = Pipeline([

("pre", lgd_pre),

("rf", RandomForestRegressor(n_estimators=300, random_state=40))

])

lgd_model.fit(X_lgd, y_lgd)

df_lgd["LGD_exp"] = np.clip(

lgd_model.predict(df_lgd.drop(columns=["Risk", "true_default", "LGD_prior", "LGD_obs"])),

0.10, 0.99

)Exposure at Default

Simulating EAD since the dataset lacks this column.

Formula (Basel/IFRS 9 style):

EAD = Balance + CCF * Undrawn

Balance = Amount withdrawn - Amount repaid

CCF = Credit Conversion Factor = Percentage defaulters withdraw just before defaultingIn practice, banks use observed balances and limits. Assumptions:

- Base utilization: random 50–95% of the credit amount

- Risk adjustment: riskier borrowers (high PD) repay less

- CCF fixed at 80% (typical Basel retail assumption)

rng = np.random.default_rng(50)

base_frac = np.clip(rng.normal(0.65, 0.1, size=len(df_lgd)), 0.3, 0.8)

risk_adj = df_lgd["PD"] * 0.2

balance_frac = np.clip(base_frac + risk_adj, 0.5, 0.95)

df_lgd["Withdrawn"] = df_lgd["Credit_amount"] * balance_frac

df_lgd["Undrawn"] = df_lgd["Credit_amount"] - df_lgd["Withdrawn"]

repay_frac = (1 - df_lgd["PD"]) * 0.8

df_lgd["Repaid"] = df_lgd["Withdrawn"] * repay_frac

df_lgd["Balance"] = df_lgd["Withdrawn"] - df_lgd["Repaid"]

CCF = 0.8

df_lgd["EAD"] = df_lgd["Balance"] + CCF * df_lgd["Undrawn"]Expected Credit Loss

This block computes 12-month ECL.

- Formula:

ECL = PD * LGD * EAD * discount factorWe report portfolio-level stats and segment summaries:

- By Purpose

- By Property * EAD buckets (qcut)

# EIR, one year discount, assumed flat 5% for demonstration

annual_rate = 0.05

discount_factor = 1/(1+annual_rate)

df_lgd["ECL_12m"] = df_lgd["PD"] * df_lgd["LGD_exp"] * df_lgd["EAD"] * discount_factor

print(df_lgd.loc[true_defaults, ["Credit_amount", "PD", "LGD_exp", "EAD", "ECL_12m"]].head())

# Portfolio summaries

print("\n=== Portfolio summary ===")

print("Total EAD:", df_lgd["EAD"].sum().round(2))

print("Total 12m ECL:", df_lgd["ECL_12m"].sum().round(2))

print("Average PD:", df_lgd["PD"].mean().round(3))

print("Average LGD (expected):", df_lgd["LGD_exp"].mean().round(3))

print("ECL / EAD (portfolio charge):", (df_lgd["ECL_12m"].sum() / df_lgd["EAD"].sum()).round(4))

# segment views; purpose and ECL_12m

purpose_ecl = df_lgd.groupby("Purpose")["ECL_12m"].sum()

purpose_ead = df_lgd.groupby("Purpose")["EAD"].sum()

print("\n=== Segment summary (by Purpose) ===")

print(purpose_ecl)

print(f"")

print("ECL density by Purpose:", (purpose_ecl / purpose_ead).round(3))

# Segment views ('Property' and credit size bucket)

EAD_bins = pd.qcut(df_lgd["EAD"], q=4, duplicates="drop")

seg = (

df_lgd.groupby(["Property", EAD_bins], observed=True).agg(

n_accounts = ("PD", "size"),

avg_PD = ("PD", lambda x : round(x.mean(), 3)),

avg_LGD = ("LGD_exp", lambda x : round(x.mean(), 3)),

total_EAD = ("EAD", lambda x : round(x.sum(), 2)),

total_ECL_12m = ("ECL_12m", lambda x : round(x.sum(), 2))

)

.reset_index()

.rename(columns={"EAD": "EAD_bucket"})

)

seg["EAD_bucket"] = seg["EAD_bucket"].apply(

lambda interval: f"({round(interval.left)}, {round(interval.right)}]"

)

seg["ECL_density"] = (seg["total_ECL_12m"] / seg["total_EAD"]).round(4)

seg.to_csv('segment_view_risk.csv', index=False)

print("\n=== Segment summary (Property x EAD quartiles) ===")

print(seg.head(12)) Credit_amount PD LGD_exp EAD ECL_12m

652 2303 0.531489 0.359326 1521.195638 276.681021

37 2100 0.354955 0.293431 1101.943958 109.307133

11 4308 0.933333 0.352556 3963.541164 1242.105770

835 1082 0.654954 0.444322 809.159763 224.260676

602 1837 0.836684 0.658926 1590.620854 835.170420

=== Portfolio summary ===

Total EAD: 1947602.14

Total 12m ECL: 388994.37

Average PD: 0.304

Average LGD (expected): 0.42

ECL / EAD (portfolio charge): 0.1997

=== Segment summary (by Purpose) ===

Purpose

business 62107.415868

car (new) 89684.227220

car (used) 57442.869251

domestic appliances 2448.678718

education 30987.449345

furniture/equipment 60683.183727

others 29062.256335

radio/TV 48750.111199

repairs 7401.139585

retraining 427.036980

Name: ECL_12m, dtype: float64

ECL density by Purpose: Purpose

business 0.237

car (new) 0.206

car (used) 0.185

domestic appliances 0.226

education 0.300

furniture/equipment 0.182

others 0.374

radio/TV 0.130

repairs 0.208

retraining 0.079

dtype: float64

=== Segment summary (Property x EAD quartiles) ===

Property EAD_bucket \

0 building society savings agreement / life insu... (124, 691]

1 building society savings agreement / life insu... (691, 1213]

2 building society savings agreement / life insu... (1213, 2346]

3 building society savings agreement / life insu... (2346, 17164]

4 car or other, not in attribute 6 (124, 691]

5 car or other, not in attribute 6 (691, 1213]

6 car or other, not in attribute 6 (1213, 2346]

7 car or other, not in attribute 6 (2346, 17164]

8 real estate (124, 691]

9 real estate (691, 1213]

10 real estate (1213, 2346]

11 real estate (2346, 17164]

n_accounts avg_PD avg_LGD total_EAD total_ECL_12m ECL_density

0 67 0.195 0.353 32913.11 2112.27 0.0642

1 47 0.293 0.346 43376.35 4111.39 0.0948

2 64 0.325 0.347 110146.51 12189.55 0.1107

3 54 0.428 0.351 229074.82 37153.57 0.1622

4 52 0.197 0.450 25838.35 2193.87 0.0849

5 94 0.236 0.448 88733.38 8850.88 0.0997

6 88 0.316 0.448 147690.47 20193.41 0.1367

7 98 0.437 0.448 433000.47 91624.63 0.2116

8 114 0.154 0.343 54223.28 2698.26 0.0498

9 82 0.202 0.345 74198.31 4911.87 0.0662

10 64 0.259 0.349 103137.92 9135.28 0.0886

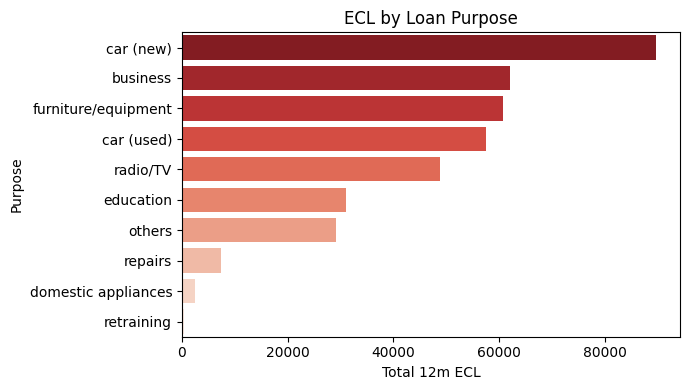

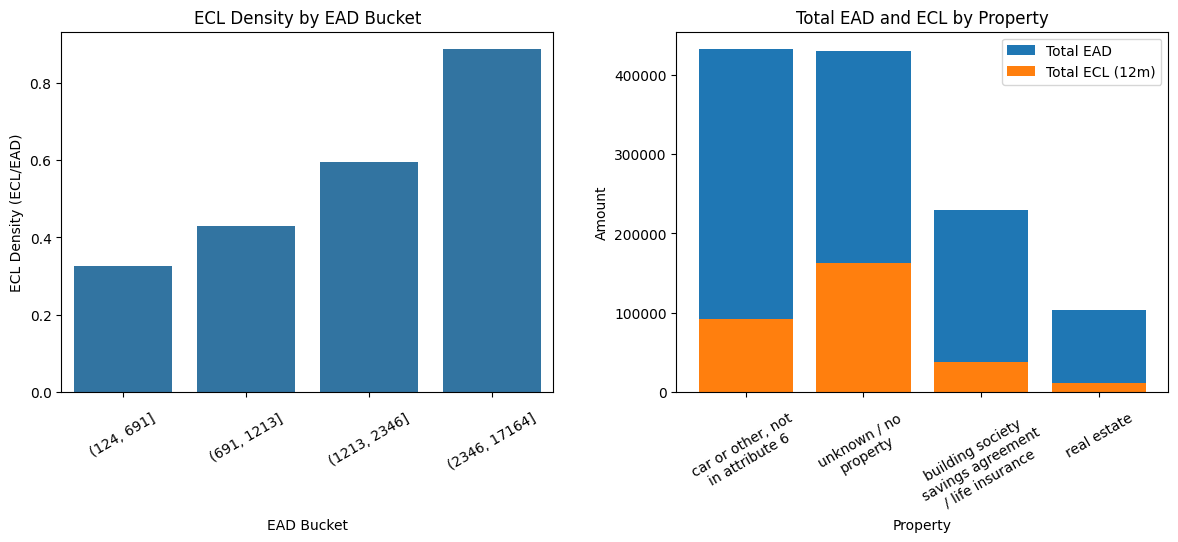

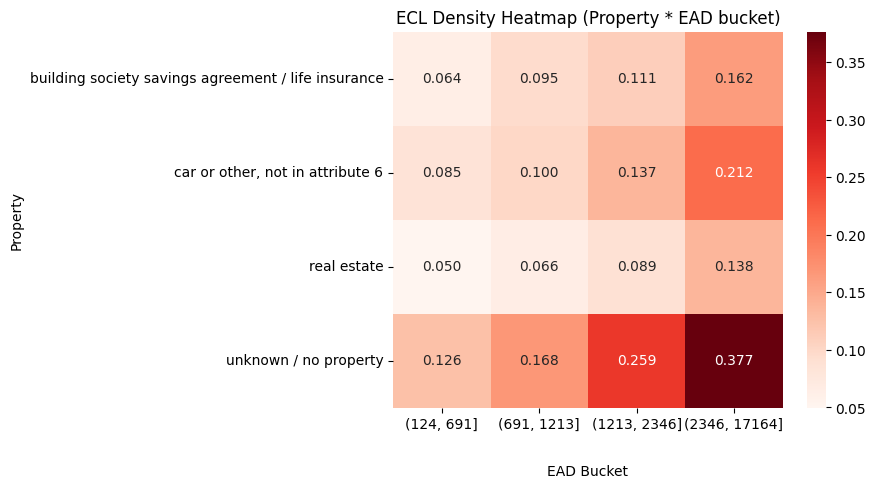

11 22 0.390 0.348 83004.16 11417.23 0.1376 Visualizing the predictions

Visualize results with:

- ECL by Purpose (barplot)

- ECL density by EAD bucket

- Total EAD vs Total ECL by Property

- ECL density heatmap (Property * EAD bucket)

pur_summary = pd.DataFrame(

purpose_ecl.sort_values(ascending=False).reset_index(),

columns = np.array(["Purpose", "ECL_12m"])

)

plt.figure(num="ECL by Loan Purpose", figsize=(7,4))

sns.barplot(data=pur_summary, x="ECL_12m", y="Purpose", hue="Purpose", palette="Reds_r")

plt.xlabel("Total 12m ECL")

plt.ylabel("Purpose")

plt.title("ECL by Loan Purpose")

plt.tight_layout()

plt.savefig(f'ECL_by_Loan_Purpose.jpg')

plt.show()

_, axes = plt.subplots(1, 2, figsize=(12, 6), num="risk_vs_acc_status_credit_amount_and_age")

# ECL density by EAD bucket

ax = sns.barplot(

data=seg,

x="EAD_bucket",

y="ECL_density",

estimator=sum,

errorbar=None,

ax=axes[0]

)

wrap_labels_(ax, width=18, rotation=30, ha="at_tick", pad=10)

ax.set_title("ECL Density by EAD Bucket")

ax.set_ylabel("ECL Density (ECL/EAD)")

ax.set_xlabel("EAD Bucket")

# Stacked bar chart total EAD and total ECL by Property

prop_summary = seg.sort_values("total_EAD", ascending=False)

axes[1].bar(prop_summary["Property"], prop_summary["total_EAD"], label="Total EAD")

axes[1].bar(prop_summary["Property"], prop_summary["total_ECL_12m"], label="Total ECL (12m)")

axes[1].set_title("Total EAD and ECL by Property")

axes[1].set_ylabel("Amount")

axes[1].set_xlabel("Property")

wrap_labels_(axes[1], width=18, rotation=30, ha="at_tick", pad=10)

axes[1].legend()

for ax in axes:

ax.xaxis.set_label_coords(0.5, -0.35)

plt.tight_layout(pad=1.5)

plt.subplots_adjust(wspace=0.25)

plt.savefig('ECL_density_total_EAD_EAD_bucket_Property.jpg')

plt.show()

# ECL density heatmap (Property * EAD bucket)

heatmap_data = seg.pivot_table(index="Property", columns="EAD_bucket",

values="ECL_density", aggfunc="mean", observed=True)

plt.figure(num="ECL Density Heatmap (Property * EAD bucket)", figsize=(9,5))

sns.heatmap(heatmap_data, annot=True, fmt=".3f", cmap="Reds")

plt.title("ECL Density Heatmap (Property * EAD bucket)")

plt.ylabel("Property")

plt.xlabel("EAD Bucket")

plt.gca().xaxis.set_label_coords(0.5, -0.15)

plt.tight_layout()

plt.savefig(f'ECL_density_heatmap.jpg')

plt.show()Stress testing predictions

Stress-test portfolio under adverse conditions:

- PD +50%

- LGD +20%

- Both combined

- Severe scenario (PD×2, LGD×1.5)

Reporting changes in portfolio ECL vs base case.

# already computed

base_ecl = df_lgd["ECL_12m"].sum().round(2)

print("Base case ECL (12m):", base_ecl)

# stress scenarios

stress_scenarios = {

"PD +50%": {"PD": 1.5, "LGD": 1.0},

"LGD +20%": {"PD": 1.0, "LGD": 1.2},

"PD +50% & LGD +20%": {"PD": 1.5, "LGD": 1.2},

"Severe stress (PD×2, LGD×1.5)": {"PD": 2.0, "LGD": 1.5}

}

# Apply scenarios

results = {}

for name, factors in stress_scenarios.items():

df_stress = df_lgd.copy()

df_stress["PD_stress"] = (df_stress["PD"] * factors["PD"]).clip(upper=1.0)

df_stress["LGD_stress"] = (df_stress["LGD_exp"] * factors["LGD"]).clip(upper=1.0)

df_stress["ECL_stress"] = (

df_stress["PD_stress"] * df_stress["LGD_stress"] * df_stress["EAD"] * discount_factor

)

results[name] = df_stress["ECL_stress"].sum().round(2)

# results

print("\nStress Test Results")

for scenario, ecl in results.items():

print(f" {scenario:30} : {ecl} (vs base {base_ecl}, change {((ecl/base_ecl)-1)*100:.1f}%)")Base case ECL (12m): 388994.37

Stress Test Results

PD +50% : 538802.69 (vs base 388994.37, change 38.5%)

LGD +20% : 466793.24 (vs base 388994.37, change 20.0%)

PD +50% & LGD +20% : 646563.23 (vs base 388994.37, change 66.2%)

Severe stress (PD×2, LGD×1.5) : 927289.15 (vs base 388994.37, change 138.4%)